The 2030 Agenda says it loud and clear: gender equality is not only a fundamental right, it’s a necessary foundation for a peaceful, prosperous and sustainable world. While 100% gender equality is a broad and ambitious goal, the way to achieve this universal goal is by focusing resources on women’s empowerment, and supporting a social context that allows for breaking down barriers for gender equality. However, we are facing a gaping, stagnant gender equality funding gap between the resources and the people that need them most. The resources do exist: last year OECD DAC donors provided $146 billion in Official Development Assistance (ODA), some of which is increasingly used to crowd-in private finance through “blended finance.” Blended finance refers to the strategic use of development finance for the mobilisation of additional (primarily commercial) finance towards sustainable development in developing countries. For example, Goldman Sachs and IFC partnered up to create a loan facility for women-owned enterprises, to enable women around the world to access capital and grow their businesses. With a USD 100 million investment from IFC, the Goldman Sachs Foundation added USD 43 million to this facility. In fact, the OECD estimates that official development finance interventions mobilized USD 81 billion in private investment over four years.

Now, we need to connect more women with more resources like this, using more strategic acumen required to advance a proactive gender equality policy agenda.

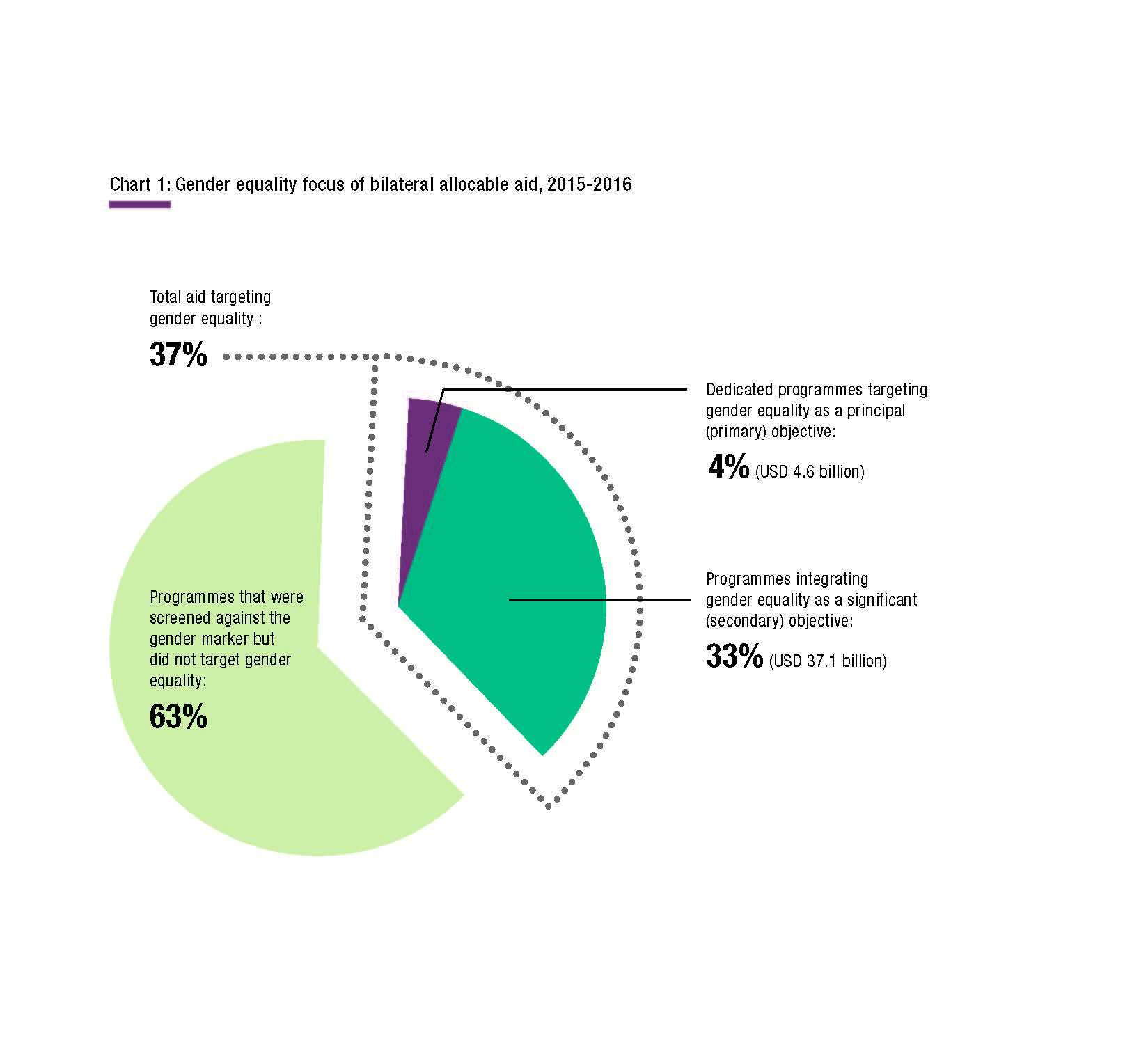

The OECD Development Assistance Committee Gender Equality Policy Marker, developed more than two decades ago, is used to monitor donor support for gender equality and women’s empowerment across development activities. Our analysis reveals that, in 2015-16, just USD 4.6 billion per year – only 4% of bilateral aid – was dedicated to gender equality as a main objective. This figure has been static since 2010.[1] In the economic and productive sectors, such as infrastructure or banking, only 1% of aid was dedicated to gender equality and women’s empowerment as the main objective, which represents a decrease compared to previous years.

All sources of financing must be leveraged to ensure no woman or girl is left behind. While blended finance has great potential to mobilize new funding flows, it also mobilizes new actors, bringing together diverse legal and financial structures, through multi-layered delivery mechanisms. The complexity of this governance architecture, including different types of actors, makes it even more important for donor governments to influence and ensure a strong focus on gender equality and women’s empowerment in blending activities.

The OECD DAC Blended Finance Principles for Unlocking Commercial Finance for the Sustainable Development Goals represent a first step for donor governments to align their strategies and practices with development priorities, including gender equality (SDG5). The 2018 OECD report Making Blended Finance work for the SDGs revealed that SDG 5 is well targeted by blended finance “facilities” (mostly public), but much less so by “funds” (mainly commercial investors).[2] Gender equality is thus more likely to be prioritized by investment instruments where public or other donors are directly involved. This means that, with the right strategic design, driven by donors, blending has the potential to promote a stronger focus on gender equality and women’s empowerment by commercial investors and privately managed investment vehicles.

Further work is also needed to understand the extent to which blended finance can support – and avoid undermining – gender equality and women’s empowerment. We should not expect the responsibility of the gender equality funding gap to be answered by blended finance alone. Official development assistance will remain an essential vehicle to support women’s rights, especially in the least developed countries. At the same time, there is clearly a need for donors to better incentivise commercial investors to align further with development objectives that support gender equality and women’s empowerment in blending activities. For example, commercial investors can aim to focus their investments in financial services providers on those providers that offer products and services accessible to women.

At the OECD, together with the DAC Network on Gender Equality (GENDERNET) members from DAC development agencies and international organizations, we will continue to monitor and analyze all development finance flows focused on gender equality, with the aim of increasing investments. We will also work to make development finance beyond aid, including blended finance and financing provided by commercial investors, focus more on gender equality and women’s empowerment, in order to close the gender equality funding gap.

See more at: http://www.oecd.org/dac/gender-development/ and http://www.oecd.org/dac/financing-sustainable-development/.

[1] OECD DAC GENDERNET, Aid to gender equality and women’s empowerment: An Overview. July 2018

[2] Based on the OECD methodology, “facilities” are defined as earmarked allocations of development resources (mostly public but sometimes from philanthropies), which can invest in blending through a range of instruments including by purchasing shares in collective vehicles such as funds. “Funds” financial vehicles that pool solely commercial investors or more often bring together development-oriented and commercial-oriented investors. See OECD (2018), Making Blended Finance Work for the SDGs, http://www.oecd.org/dac/making-blended-finance-work-for-the-sustainable-development-goals-9789264288768-en.htm.